How to Create a Loan Program?

This article summarizes how System Admin. user role can create, copy, and manage programs.

Step-by-step guide

-

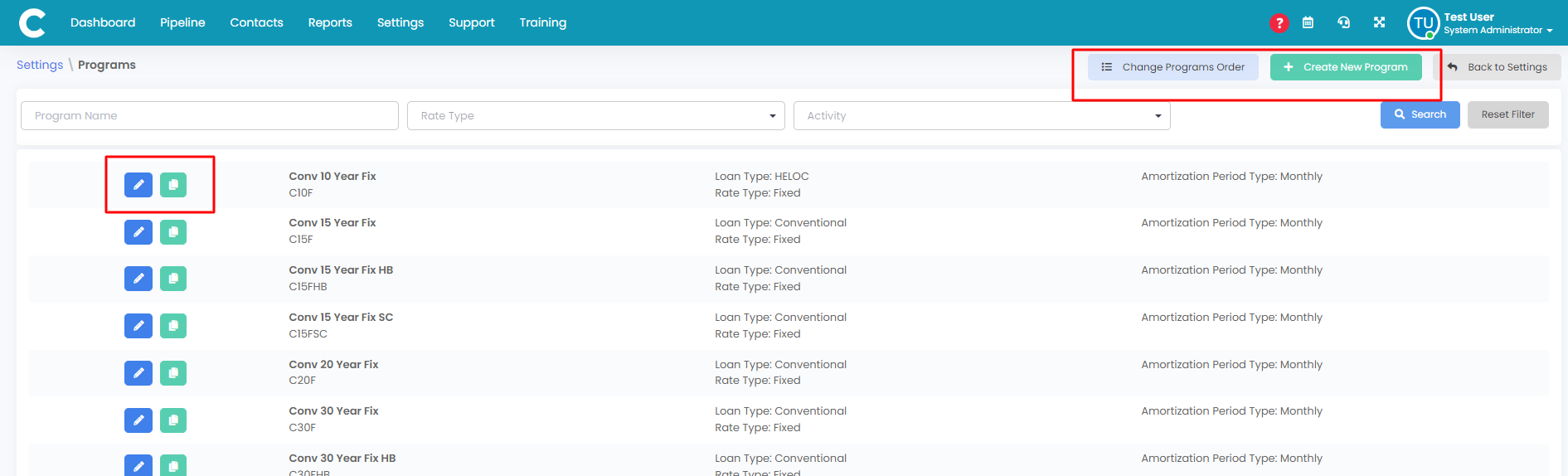

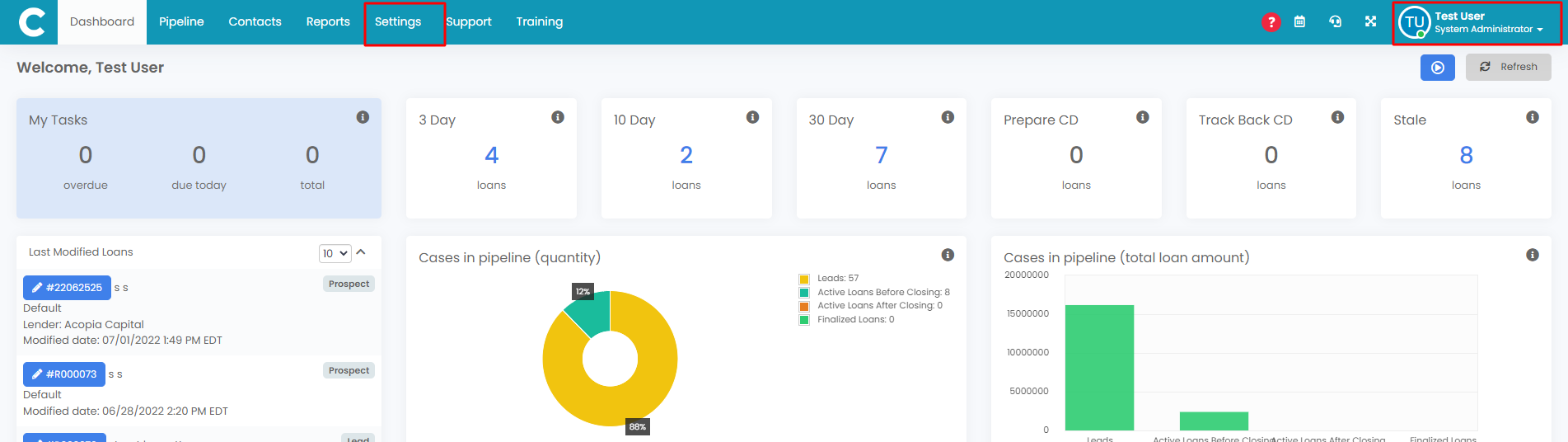

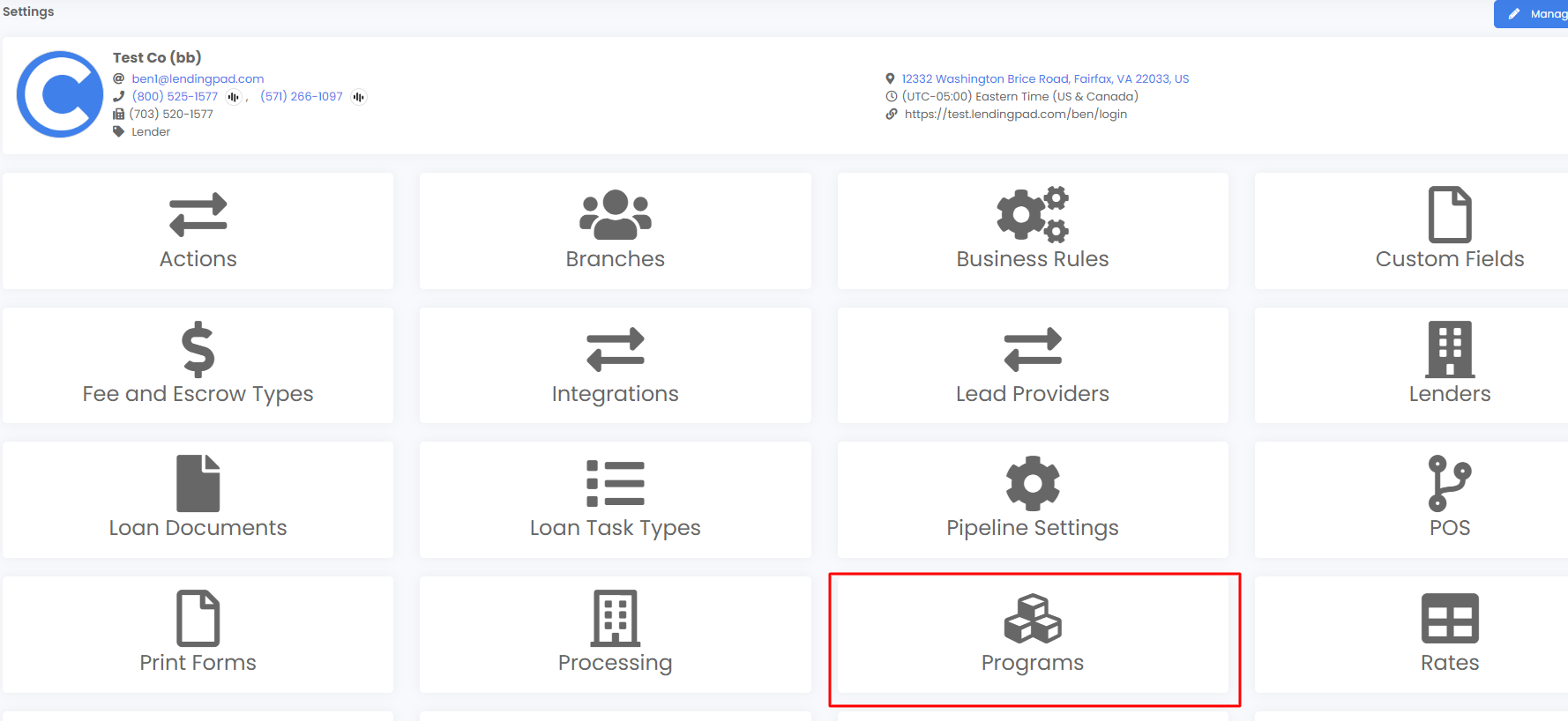

Login to LendingPad as a system administrator and click Settings in the top color bar.

2. Click on “Programs”.

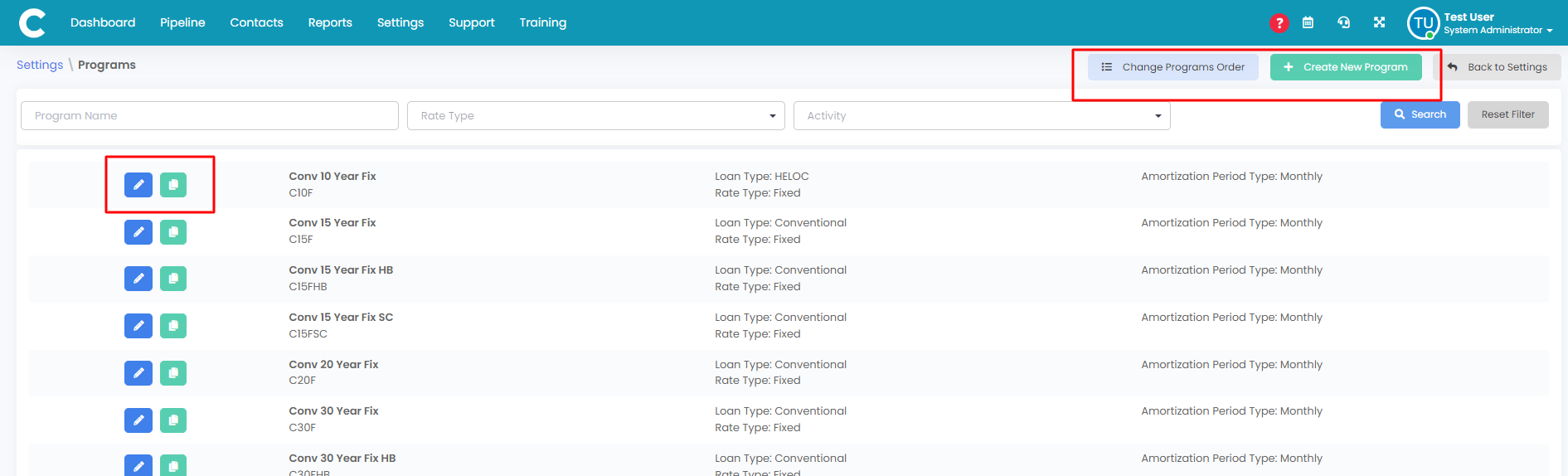

3. From here can edit current programs in the list, create a new program, copy an existing program and alter parameters, or rearrange the order of the programs that appear within each loan file.

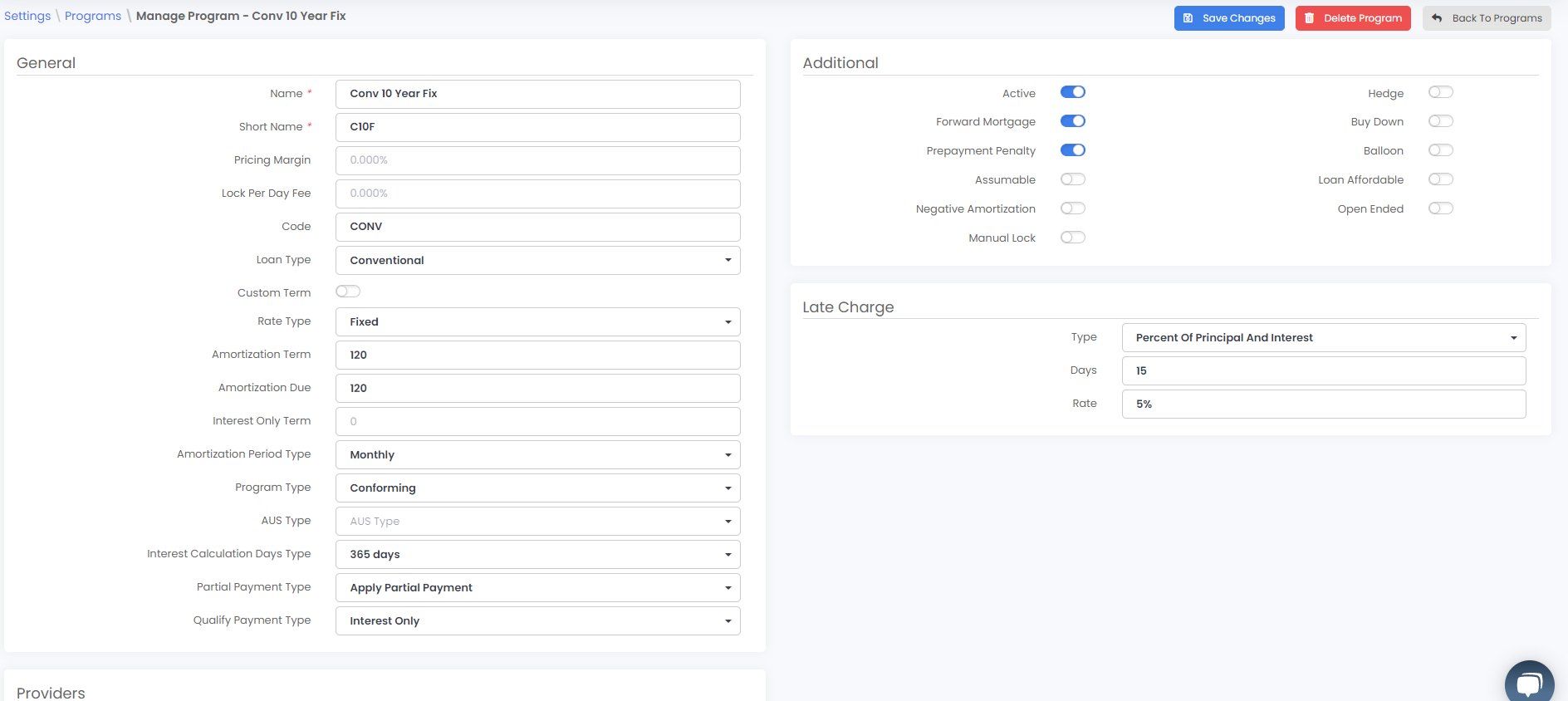

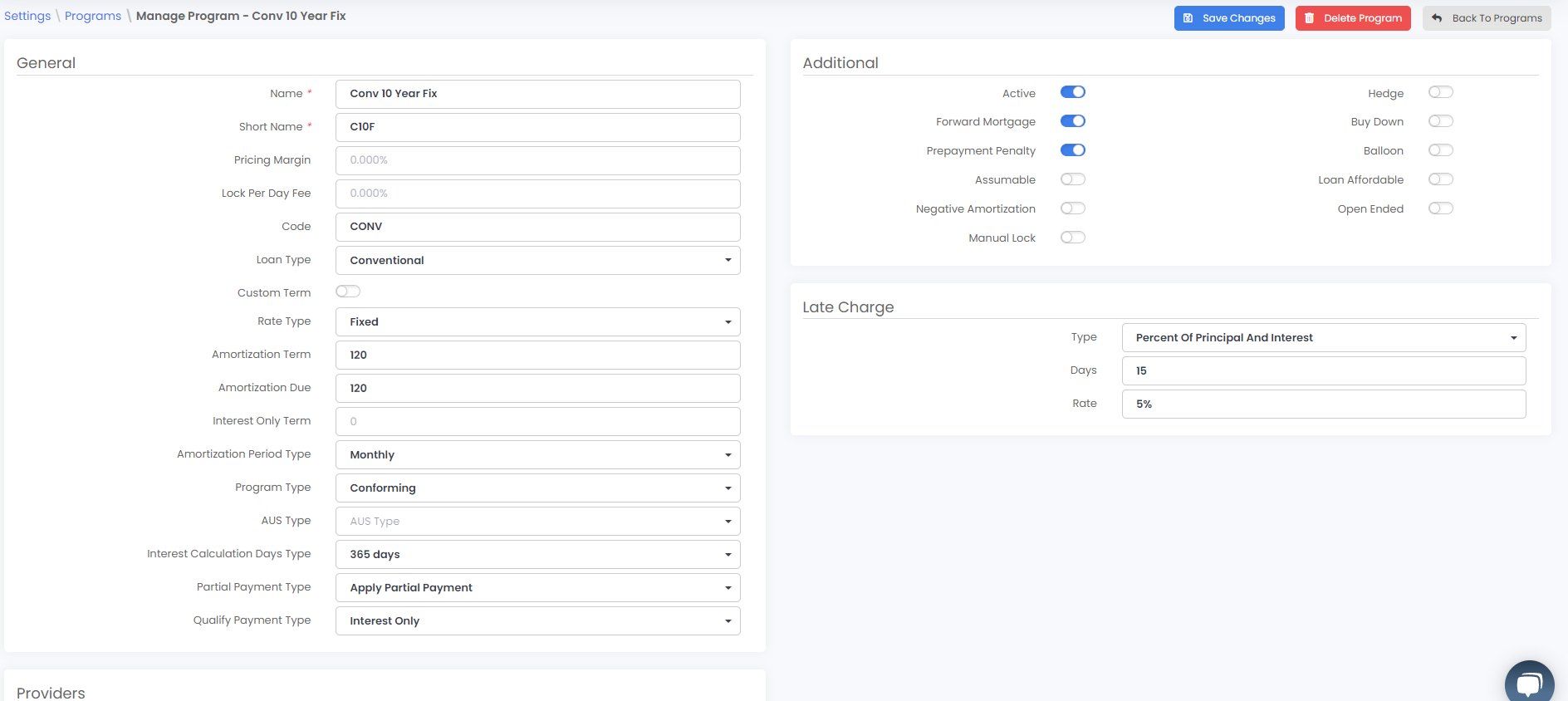

5. Input all the required information and click on “Save Changes”. Please note: For loans with an IO term the amortization will be calculated based on the Amortization term field + IO field to give a total amortization. Please setup the program accordingly to get a total that aligns with your program's total amortization period.

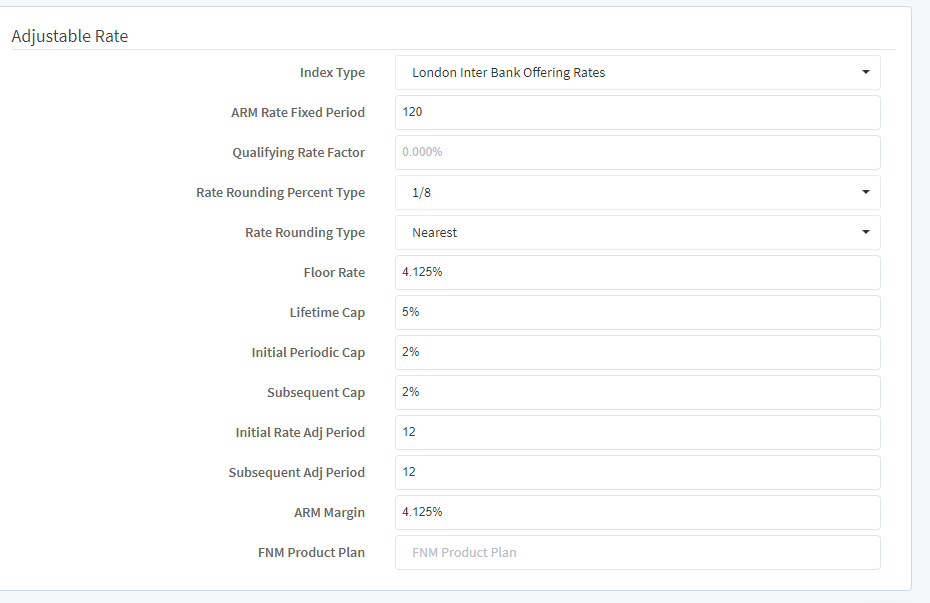

6. If you selected “Rate Type” as “Adjustable Rate”, Input all the required adjustable-rate information like Index, Arm rate, Caps, etc.

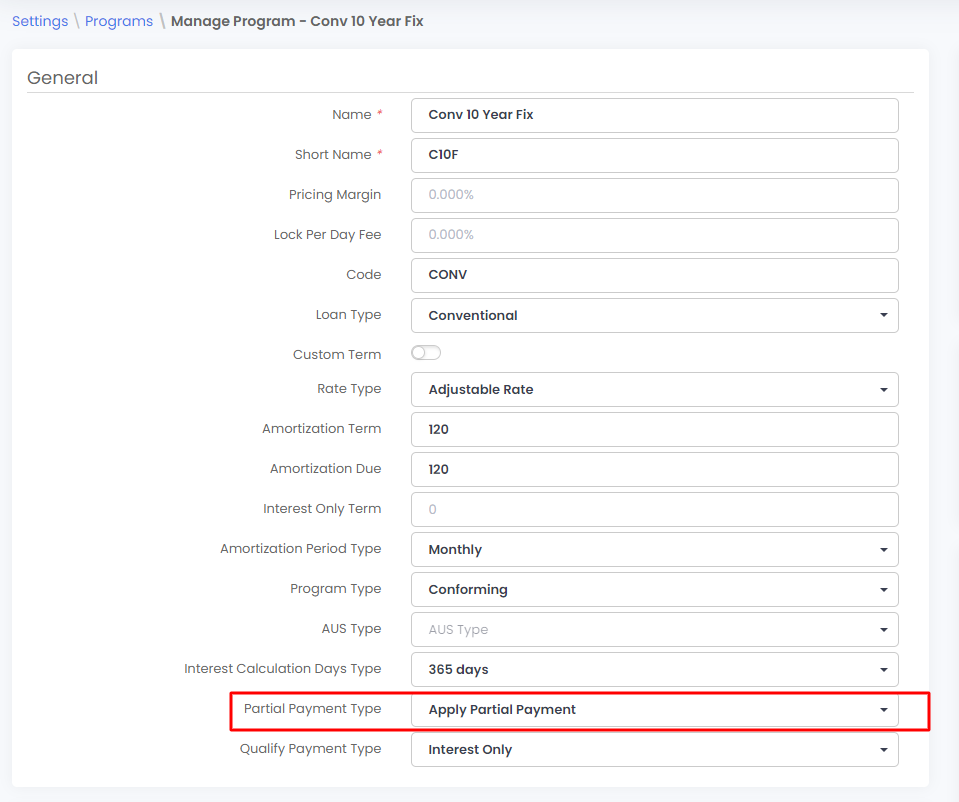

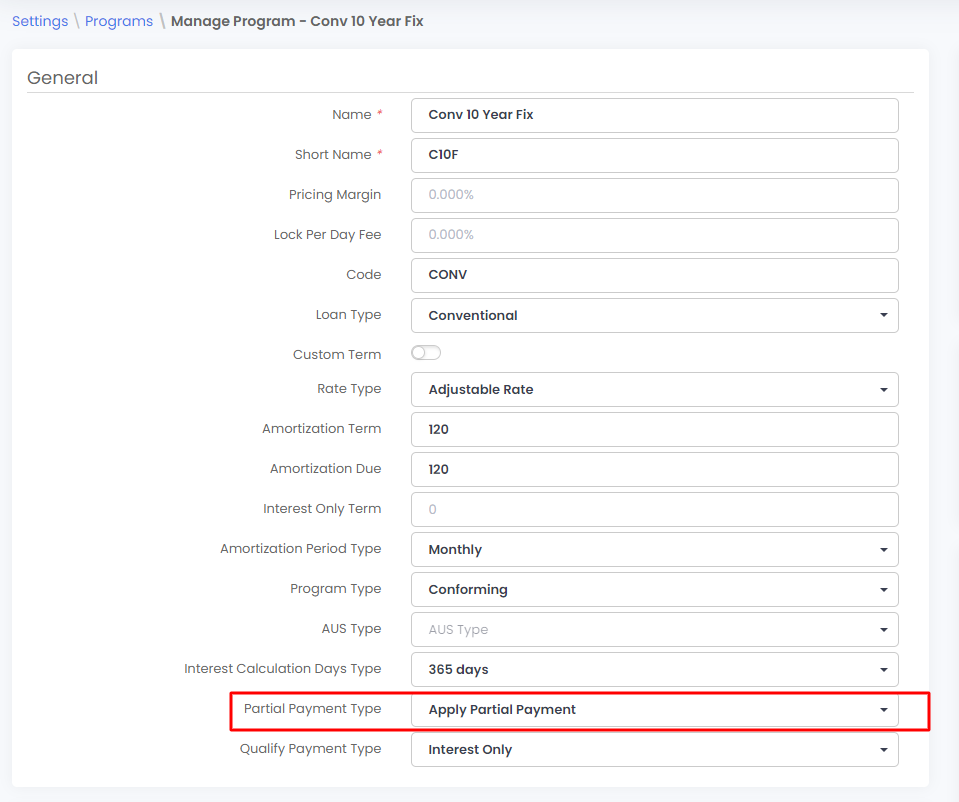

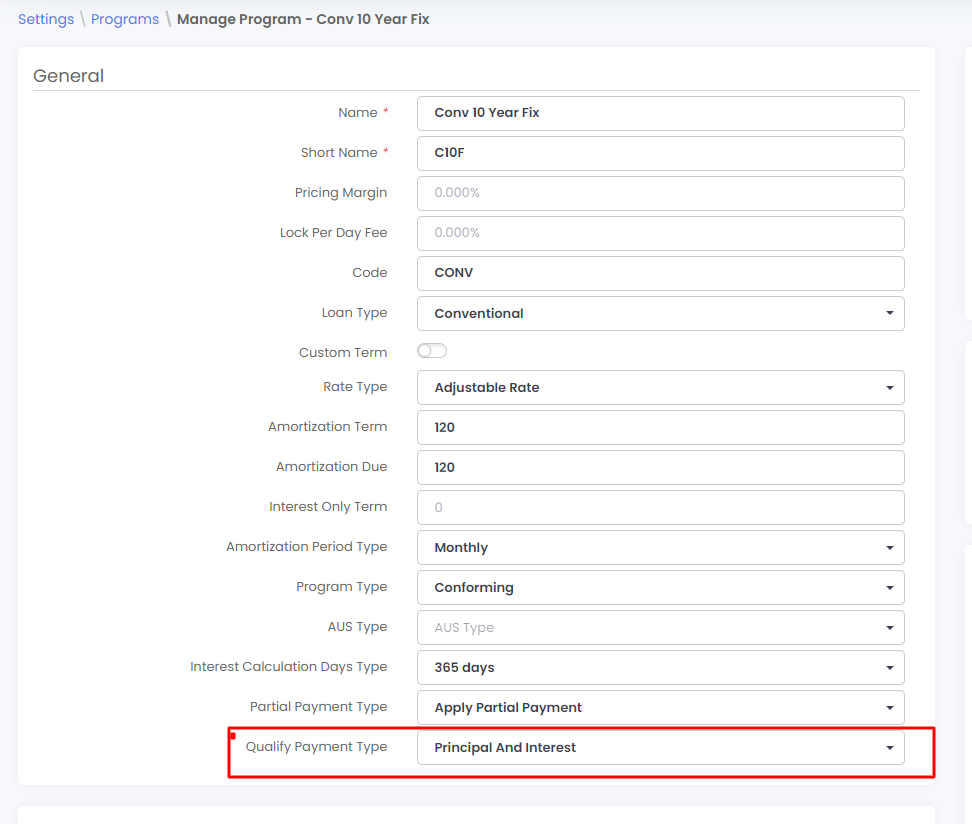

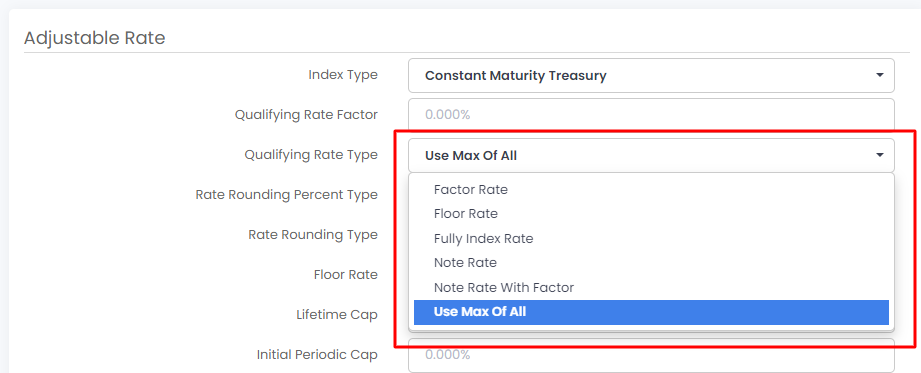

***As of 7/2 Partial Payment type, Qualify Payment Type, and Qualifying Rate Type options will be available in the program settings to further define program parameters****

1. Partial Payment Type - This field will indicate which check box is to be checked to generate a correct answer to the Partial Payments section on pages 4 of 5 of the Closing Disclosure. It is no longer set in the Print forms > Settings button.

2. Qualify Payment Type - This will allow Admins the ability to qualify using either the interest-only term set in the Interest Only Term field or the P&I for the fully amortized period. So, companies will be able to create an Interest Only program and by choosing the Principal And Interest option it would calculate the DTI based on the difference between the IO term and the Amortization term. The third option is to choose the Fully Amortized Term PI. This option will calculate the DTI at the full amortization term entered. Please note, if Interest Only is chosen and the Interest Only Term field is blank the system will still calculate DTI based on the Interest Only. For "regular" loans where this does not apply please make sure the Principal and Interest option is chosen.

3. When creating an ARM product admins will now have the option to choose a qualified rate type. Options in the drop-down allow for flexibility to choose which option to qualify for the loan with.

.jpg?height=120&name=LendingPad_nobigdot_ver2%20(6).jpg)