Thoroughly test all scenario's, check with your own compliance/legal resources. It is recommended regardless of what integrations available to automate this data entry that you have a manual check step in place before issuance.

Intent to Proceed Date

Starting in April 2020, the issued date will only reflect Loan Estimate Date, and if exists, the Redisclosure Date. When the "Intent to Proceed" date exists, this expiration date will be removed. Reference https://files.consumerfinance.gov/f/documents/cfpb_kbyo_guide-loan-estimate-and-closing-disclosure-forms_v2.0.pdf page 21

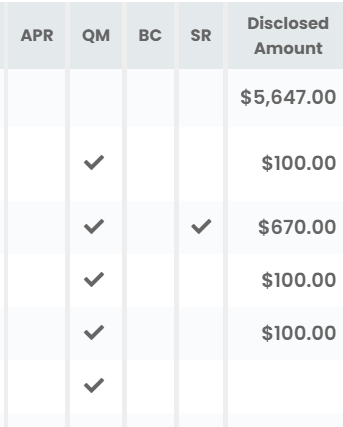

Fee Flags

APR: select yes if you like to have this fee item to be considered as part of APR calculation

QM: select yes if you want to include this fee as part of QM fees and points test

BC: Borrower-chosen. If true, Section C's title fee will stay in Section C when you generate a CD. If false, the title fee in Section C will move to Section B.

SR: Seller-responsible. These fees are seller-responsible fees in a transaction. These fees will not show in Details of Transaction.

Section A

- Use Settings → Programs and Fees to define your company fees. Define fees paid on every case here. Do not remove the defaulted Loan Origination Fee and Loan Discount Points. Broker's LPC (Lender Paid Comp) is shown in Paid by Other (L) to Broker.

Section B

- Brokers - we typically see "Appraisal Fee" and "Credit Report Fee" here to be paid to "Broker" as a fee recovery.

- Lenders - make sure all fees that's labeled with "Pay to - Lenders" will be net'ed out of funding.

- UFMIP, Funding Fee and USDA's Guarantee Fee will show up here.

- For FHA streamline cases' MIP refund,

- If user enters the refund in any of the three fields below, LendingPad will auto-sync across all three fields:

- Details of Transaction → Other Credit → MIP refund OR

- Disclosures → Payoffs and Payments OR

- Additional → Government section

- LE will generate and still show the total MIP without the refund amount. LE aggregates all amount paid on any fee.

- Other systems may recommend this refund amount not to be in POC / Borrower Paid Before Closing column, and enter as a negative number in Section H. Note that this is not the defaulted approach in LendingPad.

- If user enters the refund in any of the three fields below, LendingPad will auto-sync across all three fields:

Section C

- Title fees - can use this section to define title fees and lenders/owner's title policies. If not use title integration feature to populate fees.

- Settlement fee can be defined in Settings.

- Use "Title - " to label all title fees.

- Make sure "Paid to" party is correct. If it's an affiliate, select "Broker Affiliate" or "Lender Affiliate".

Section E

- Recording Fees - some states can be programmed either as a dollar amount default or a percentage of appraisal value, purchase price, or loan amount.

- Transfer Taxes includes any line item with the word "tax" in it. If this is not correct, you need to manually review and update before issuing LE.

- This section has zero tolerance. Manual review is recommended.

Section F

- This section is not subject to tolerance. Prepaid interest → No. of days is auto-calculated from estimated closing date.

- Per-diem can be defined to hold two or four decimal points in Settings.

Section G

- Default number of months can be defined in Settings.

- If user enters due dates and amount due, for each escrow item, system will auto-calculate aggregate adjustment.

- Aggregate adjustment can be inputted as "0" - system will not recalculate automatically even if you have a due dates and amount due. If you remove and leave no value whatsoever in Aggregate Adjustment, system will revert back to auto-calculation.

.jpg?height=120&name=LendingPad_nobigdot_ver2%20(6).jpg)