This is a step-by-step guide on how to input critical dates.

- Login to LendingPad.

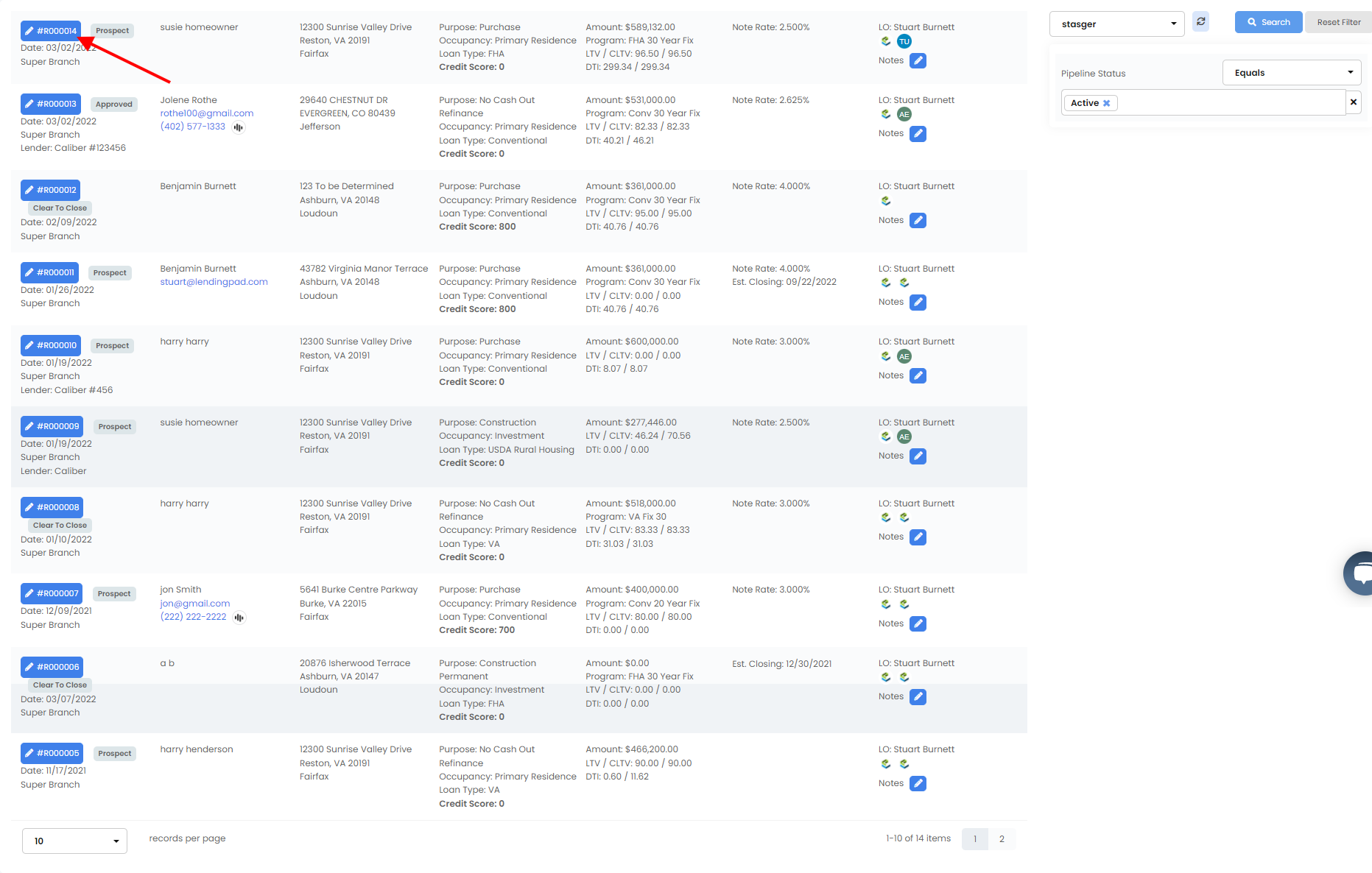

2. Click on the pipeline/Leads and open the loan.

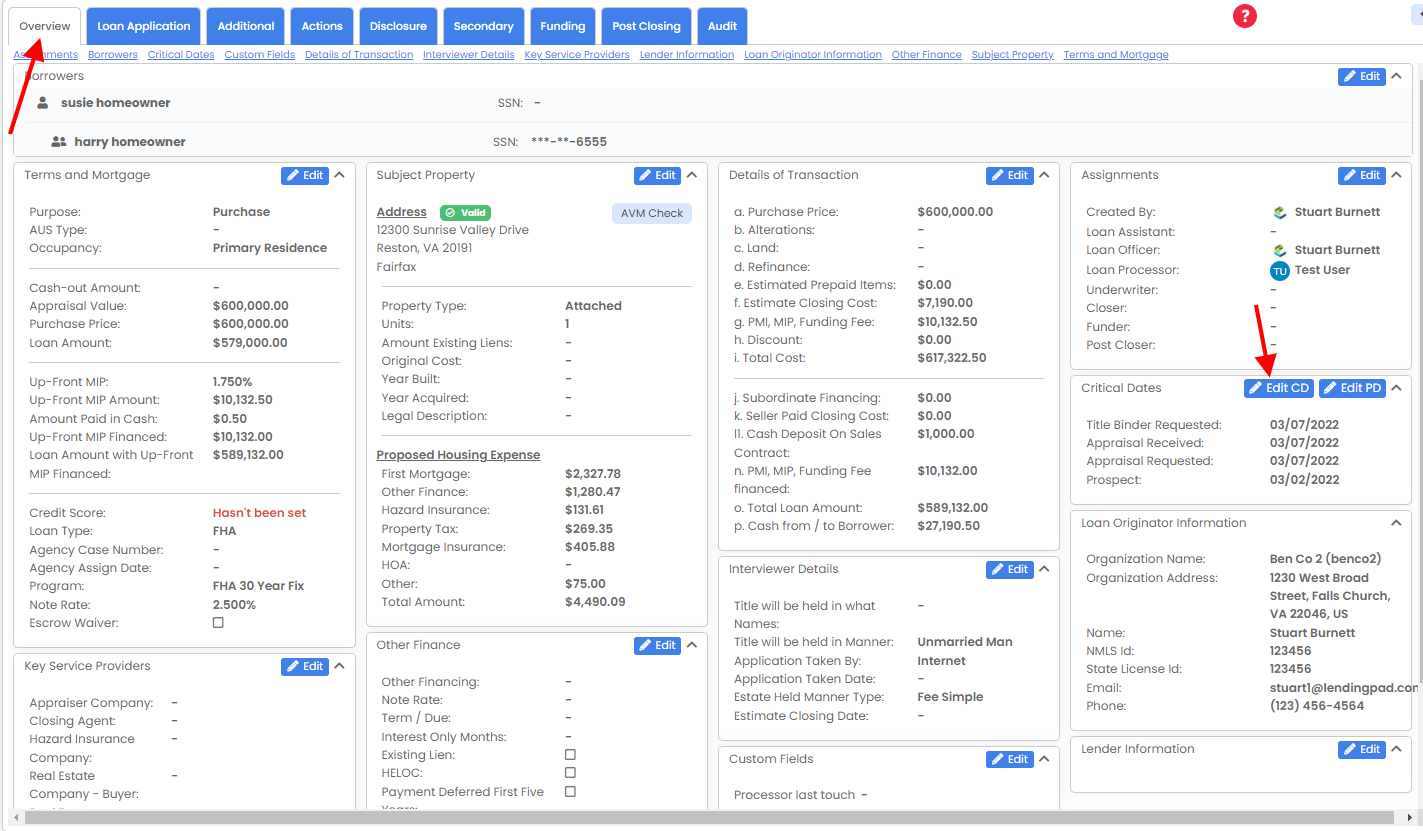

3. Click on blue button to access loan. Overview tab (system will default to this tab when accessing each loan) → Critical Dates and click on the "Edit" pencil icon. If you do not see edit button reach out to system admin or manager at your company to grant your user role access.

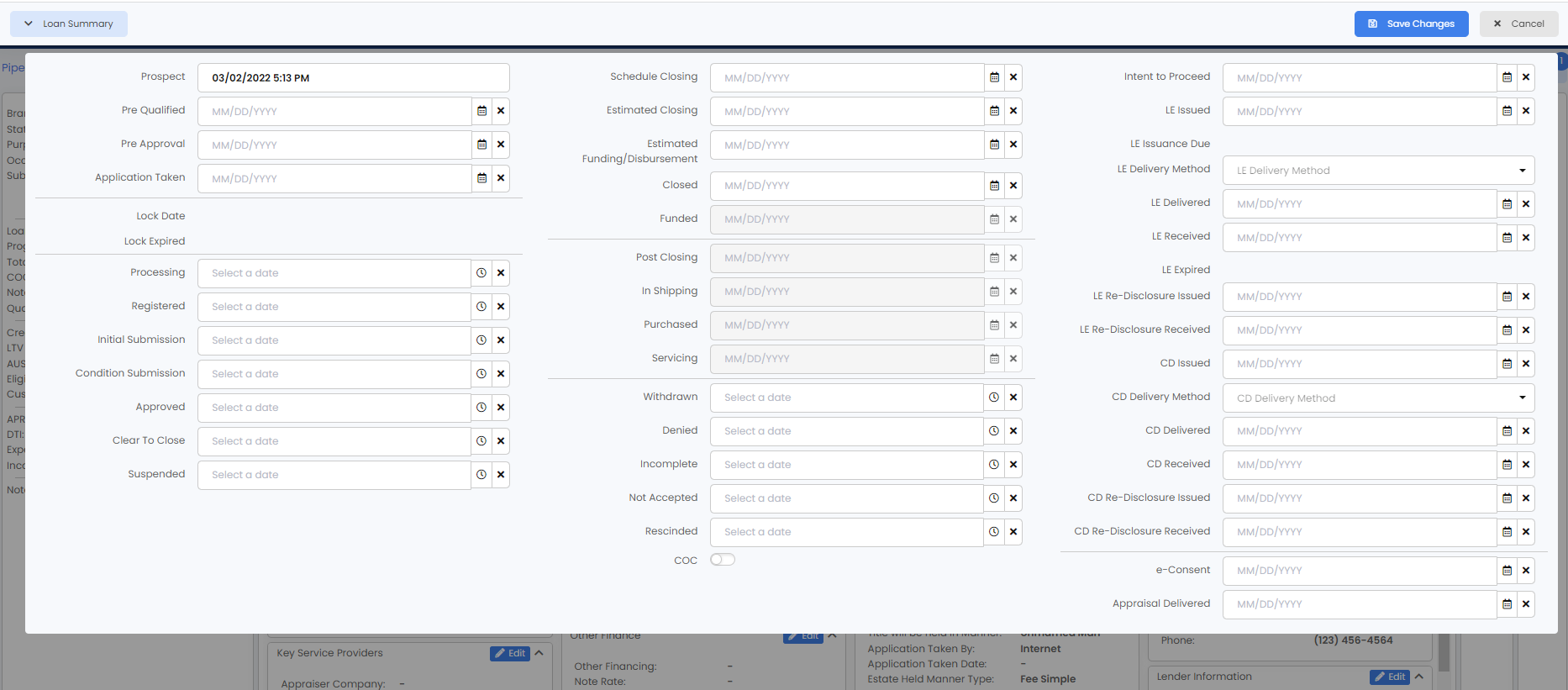

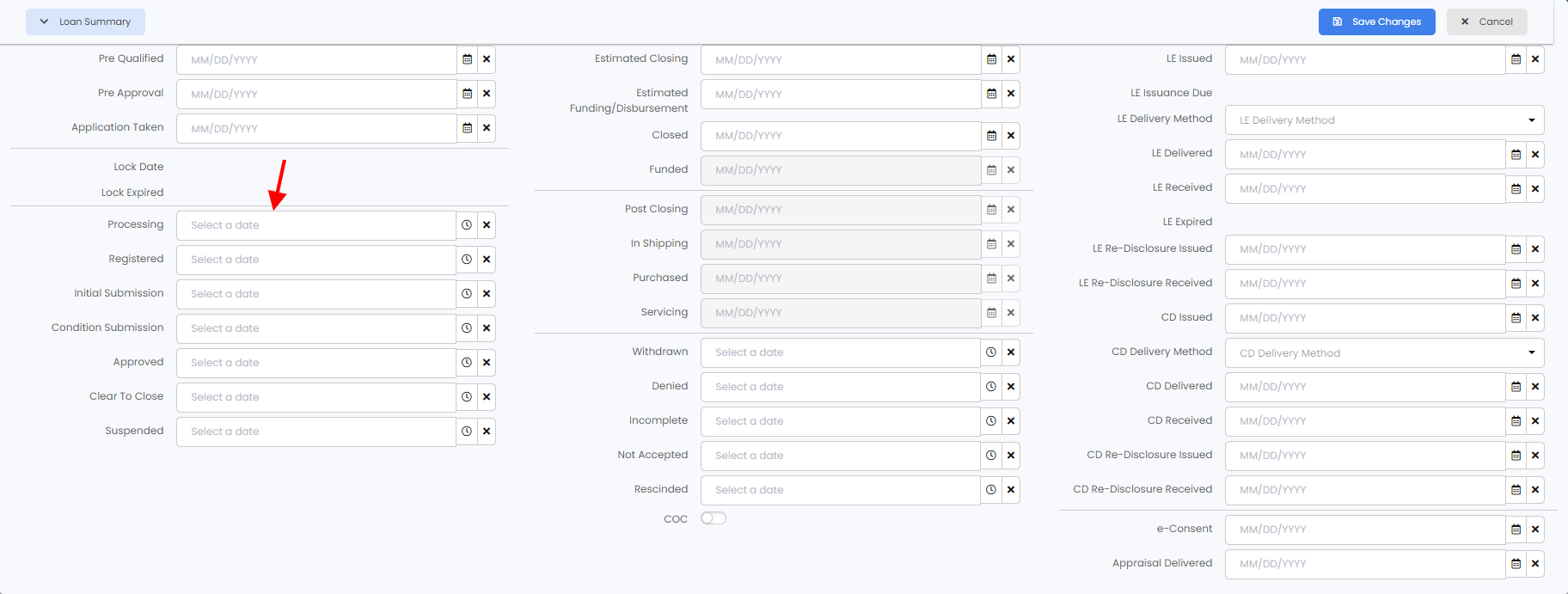

4. After clicking on the "Edit" pencil icon, critical dates window will open with all the critical dates. Generally, the date fields will work from top to bottom and left to right as the loan moves through the process.

5. Input the required status date and click on the save changes, System will automatically change the loan status when current date matches the status dates. The clock icon will stamp the critical date for the current date and time. The calendar icon will bring up a calendar to choose a date if preferred.

Unlike many other systems where users manually set a status (or milestone), LendingPad's statuses (or milestones) are automatically advanced according to current date/time. For example, if a closing date is set to be 8/1/2019, and when the current date hits midnight on 8/1/2019, system will auto-advance the loan status to "Closing" status accordingly.

LendingPad groups all statuses into four major groups. They are:

- Lead Statuses - used for loans without an application.

- Statuses: Lead, Prospect, Pre-approval, Pre-qualification.

- Active Before Closing Statuses - used for loans with application, must be disclosed, credit decisions must be made prior to closing.

- Statuses: Registered (with Lender), Application Taken, Broker Initial Submission, Initial Submission, Approved, Suspended, Pre Deny, Broker Condition Submission, Condition Submission, Clear to Close.

- Active After Closing Statuses - used for loans that are closed/funded/originated.

- Statuses - Closing, Funding, Post Closing, In Shipping

- Finalized Statuses - used by lenders for loans after funding to sale of a loan. It is also used when one of the adverse actions happens. Typically at this group, a broker or a lender needs to close out this file and no further actions are needed.

- Statuses - Servicing, Purchased, Withdrawn, Denied, Not Accepted, Incomplete, Rescinded.

Related articles

-

Page: How to Setup POS?

.jpg?height=120&name=LendingPad_nobigdot_ver2%20(6).jpg)