This article will provide guidance on how to enter a Buydown.

For those unfamiliar with what Buydown program(s) are, below are just some examples, LendingPad also allows for the flexibility to create custom buydown programs.

- A 3-2-1 buydown mortgage is a type of loan that charges lower interest rates for the first three years. In the first year, the interest rate is 3% less; in the second year, it’s 2% less; and in the third year, it’s 1% less. After that, the borrower pays the full interest rate for the remainder of the mortgage.1 For example, with a 5%, 30-year mortgage, the interest rate would be 2% in year one, 3% in year two, 4% in year three, and 5% for the remaining 27 years.

- Example of a 2-1 Buydown Mortgage: Suppose a real estate developer is offering a 2-1 buydown on its new homes. If the prevailing interest rate on 30-year mortgages is 5%, a homebuyer could get a mortgage that charged just 3% in the first year, then 4% in the second year, and 5% after that.

- 1-1-1 Buydown: A payment rate 1% lower than the note rate for the first three years on a new loan.

- 1-1 Buydown: A payment rate 1% lower than the note rate for the first two years on a new loan.

- 1-0 Buydown: A payment rate 1% lower than the note rate for the first year on a new loan.

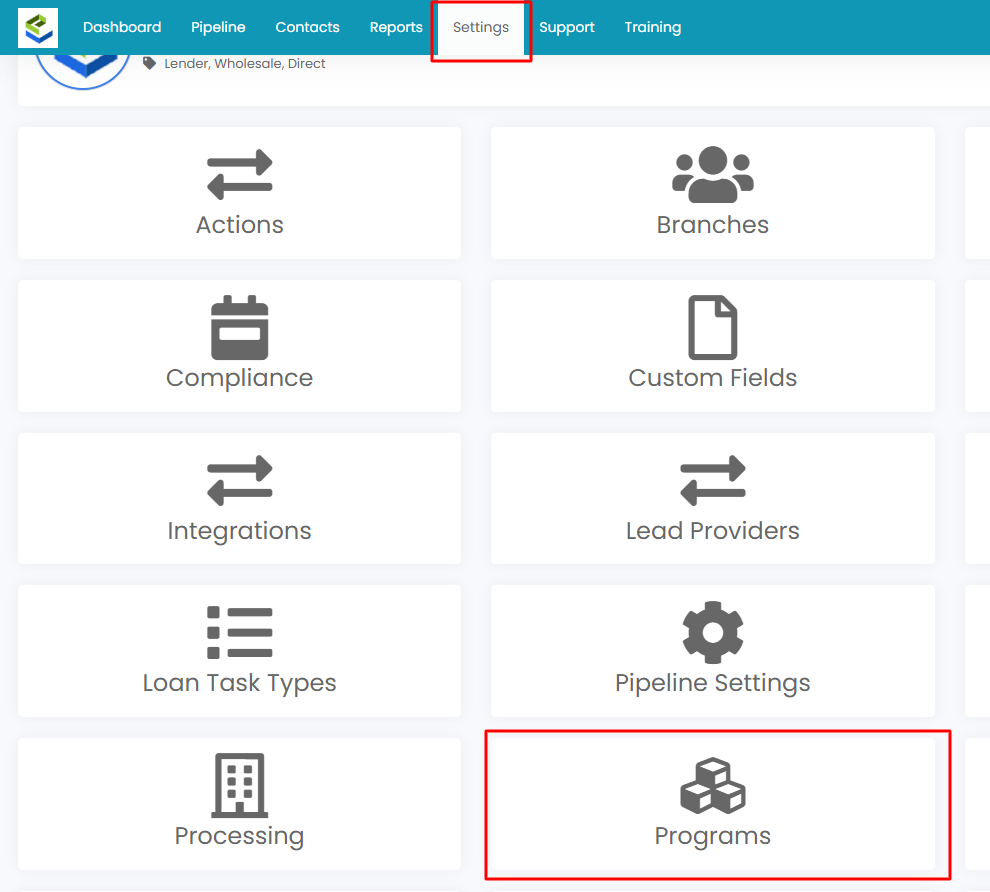

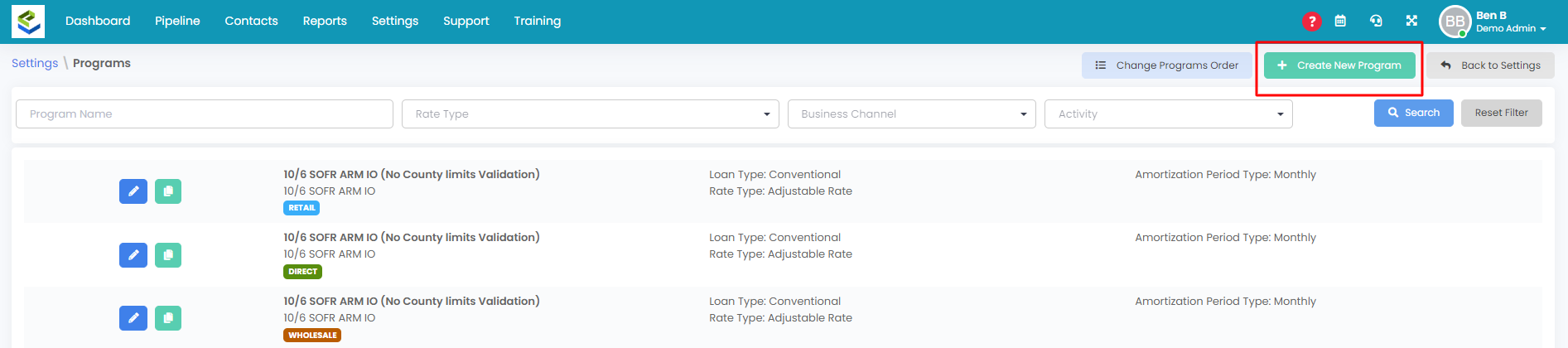

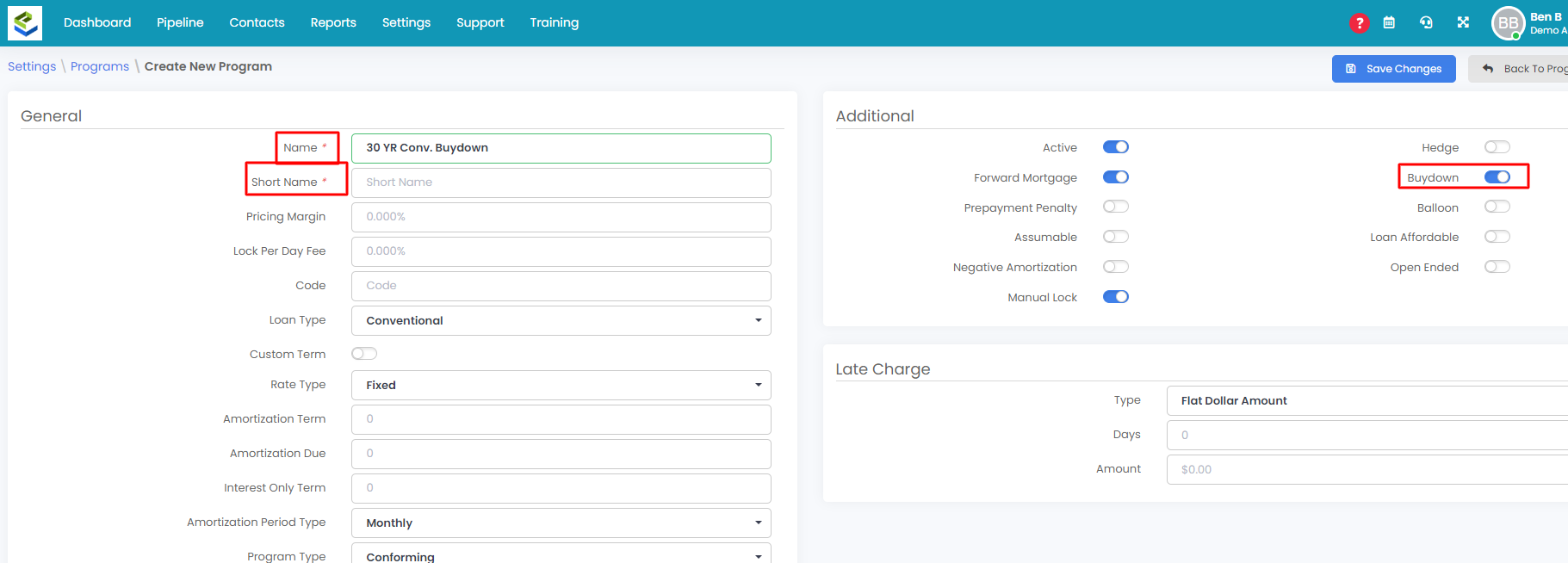

Please create the buydown program in Settings > Programs > Create > Be sure the buydown toggle is on.

Note: The buydown toggle MUST be on in order for the buydown section to appear within each loan file upon the choice of that program.

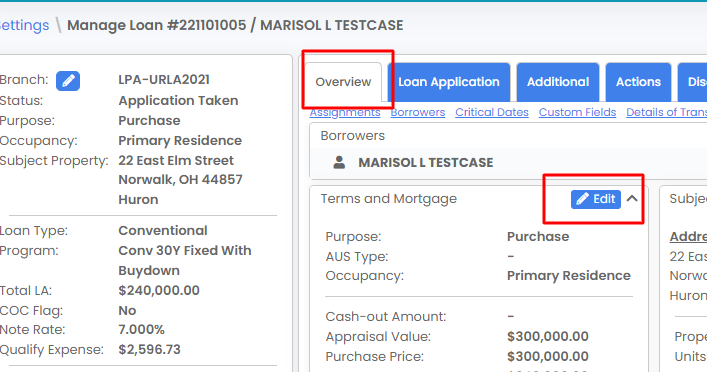

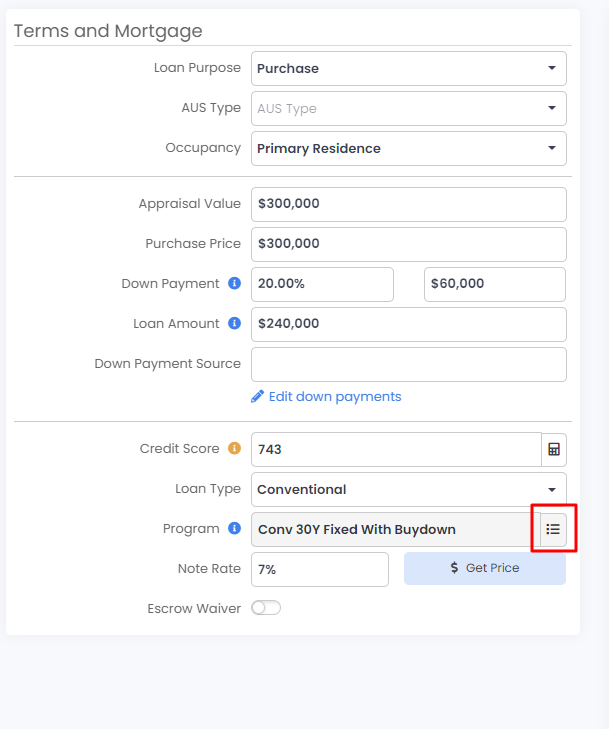

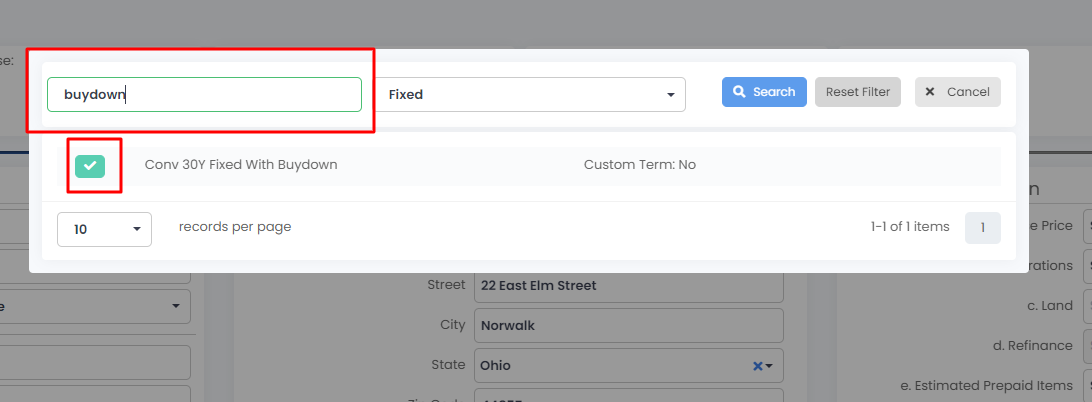

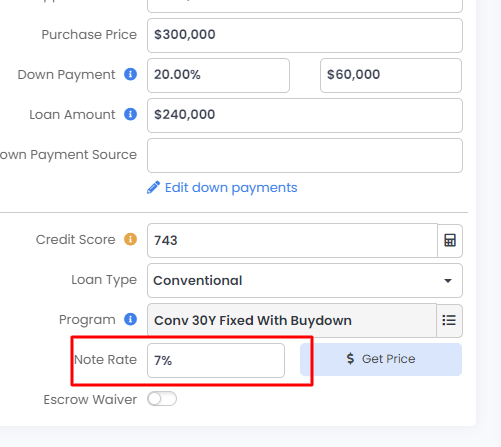

Within a file users can choose the program in the Overview tab > terms and mortgage section > program. Select the buydown program applicable and be sure to enter a Note Rate just below the Progam field. The Note rate should be the full note rate.

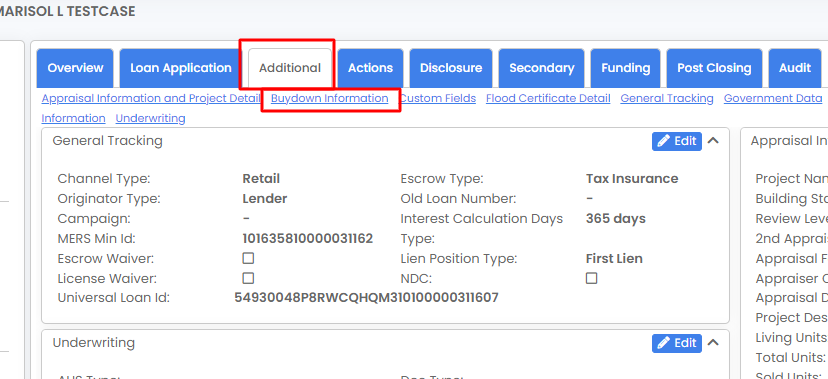

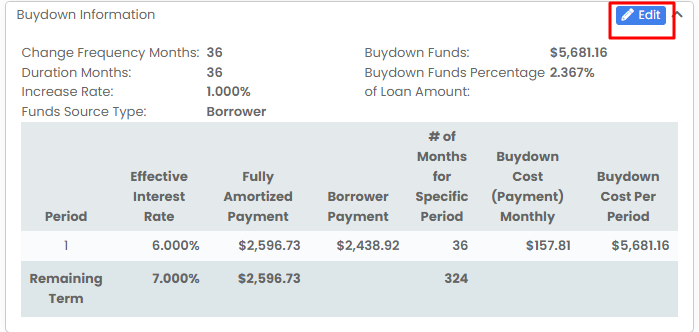

Once the program is chosen and users have saved changes they can go to the additional tab > buydown information section to complete the buydown parameters.

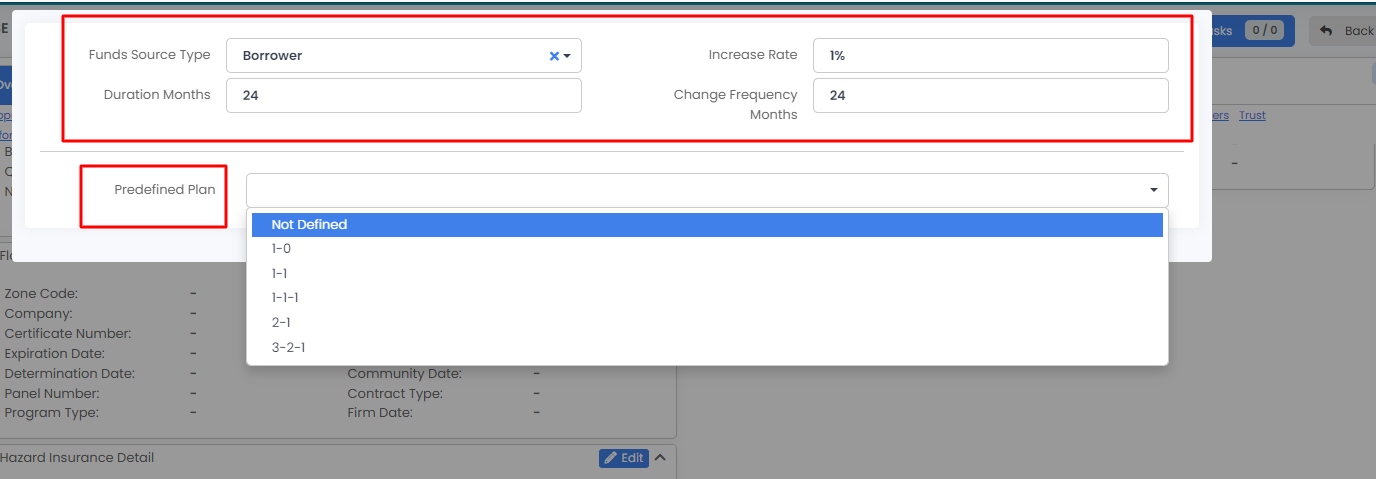

From here there is a list of pre-defined plans or can use Not Defined to create custom buydown parameters. Be sure the Funds Choice type is correct, and all other fields are complete and the system will calculate automatically.

NOTES:

- AUS, DocMagic (Make sure to use "Buydown Fee" in the disclosure Fees section as the buydown funds fee name. ), and IDS are supported to map data from the file to those vendors' docs.

- The URLA-Lender form and 1008 will auto-populate the buydown option based on the program that has been chosen.

- If the buydown is not borrower paid then the LE is structured and sent as it normally would.

- Custom Buydown Agreements can be created in the Settings > Print Forms section by system admins if required.

Please follow this Youtube Video on how to set up custom print forms.

See the link about how to run AUS in LendingPad: https://youtu.be/DZVM3OyDd1k

.jpg?height=120&name=LendingPad_nobigdot_ver2%20(6).jpg)