The LOS You've Been Waiting For

End-To-End Mortgage Solutions

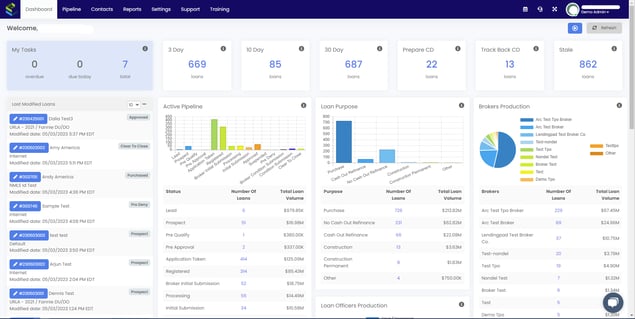

Get real-time updates and insights with our all-in-one system, designed for seamless cross-departmental collaboration and powerful analytics.

Find The Right Product For Your Business:

- Lenders/Financial Institutions

- Brokers

- Processing Centers

Lender Edition

Lend compliantly without sacrificing efficiency.

Includes all features in Broker edition plus:

- Secondary, funding, and post-closing functions with an unlimited number of users.

- Capability to perform banking functions and warehousing activities.

- Administration of third-party channels, and complete secondary tasks with institutional investors.

- Unparalleled enterprise API.

Platform reliability with unprecedented support, scalability performance, and internal admin capabilities.

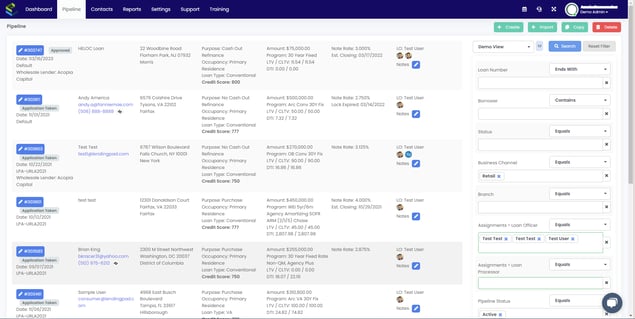

Broker Edition

A simplified platform allowing you to get back to building your pipeline.

Increase efficiency and shorten the lending cycle with:

- Simplified, intuitive screens.

- Multi-user processing and real-time notifications.

- Complementary POS facilitating a seamless borrower experience.

- Direct wholesale integration and more.

Complete the origination process with ease and confidence.

Processing Edition

Centralize and simplify your working pipeline.

Empower, expand, and close with:

- Single sign-on access to act as an extension of any client's existing back-office team.

- Task segmentation to efficiently streamline multi-client pipeline management.

- Multiple role definitions, including processor, manager, closer, funder and post closer.

- Minimize data transfer issues with a centralized source system.

Complete the origination process with ease and confidence.

Customer Success Stories

Our Clients Believe Us.

"Its a great system- the more you use it, the more you understand &like it."

You can go back and forth and change and add & play with it till you're comfortable and all is where you want it to be. Others have this feature which is a great asset. Its abit overwhelming at first by looking at it- but when you start breaking it down piece by piece its easy enough & alot of good info.

Marlen E.

Loan Officer

"Lendingpad, all in once"

I like that we can add every detail about our borrowers, and any teammate will be able to see it. From names, AKAs, and properties owned to employment, liabilities, and more! Plus, you can send the requests through Lendinpad, title requests, VOE, Hazard Insurance and more, so it makes my life easier by just clicking on the preview and then send. Additionally, you can balance your closing disclosure on the platform, and it even helps you calculate some of the fees.

Fernanda M.

Operations Assistant

"Its a great system- the more you use it, the more you understand &like it."

You can go back and forth and change and add & play with it till you're comfortable and all is where you want it to be. Others have this feature which is a great asset. Its abit overwhelming at first by looking at it- but when you start breaking it down piece by piece its easy enough & alot of good info.

Marlen E.

Loan Officer

"Lendingpad, all in once"

I like that we can add every detail about our borrowers, and any teammate will be able to see it. From names, AKAs, and properties owned to employment, liabilities, and more! Plus, you can send the requests through Lendinpad, title requests, VOE, Hazard Insurance and more, so it makes my life easier by just clicking on the preview and then send. Additionally, you can balance your closing disclosure on the platform, and it even helps you calculate some of the fees.

Fernanda M.

Operations Assistant

How it Works

Working with LendingPad is simple.

1. Sign Up Now

Register your company and receive log-in credentials instantly. The system is pre-configured by industry best practices and is set up for immediate plug-and-play.

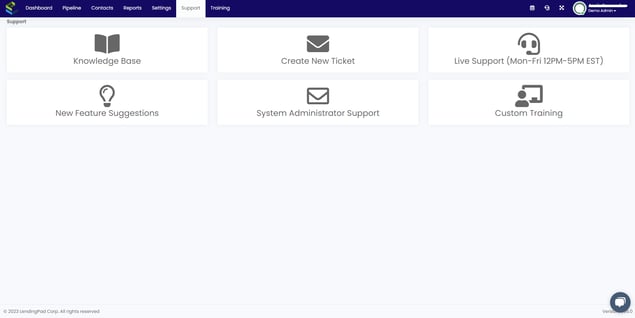

2. Receive Training

Attend monthly webinars for training and system updates. Sign up for LendingPad's certification courses and utilize our extensive training library.

3. Start Lending Better

Focus on building your pipeline and increasing the volume of closed loans. Make informed decisions faster than ever before, allowing your business to scale with unparalleled speed and accuracy.